Electric Car Tax Credit 2018 Washington State

Sales or use tax exemption available.

Electric car tax credit 2018 washington state. In washington new vehicles are subjected to a sales tax of 6 8. Up to 25 000 of the sales or lease price. With this tax credit you d be getting a rebate on the sales tax you pay up to 2 500 on new electric vehicles that cost less than. 1 2021 july 31 2023.

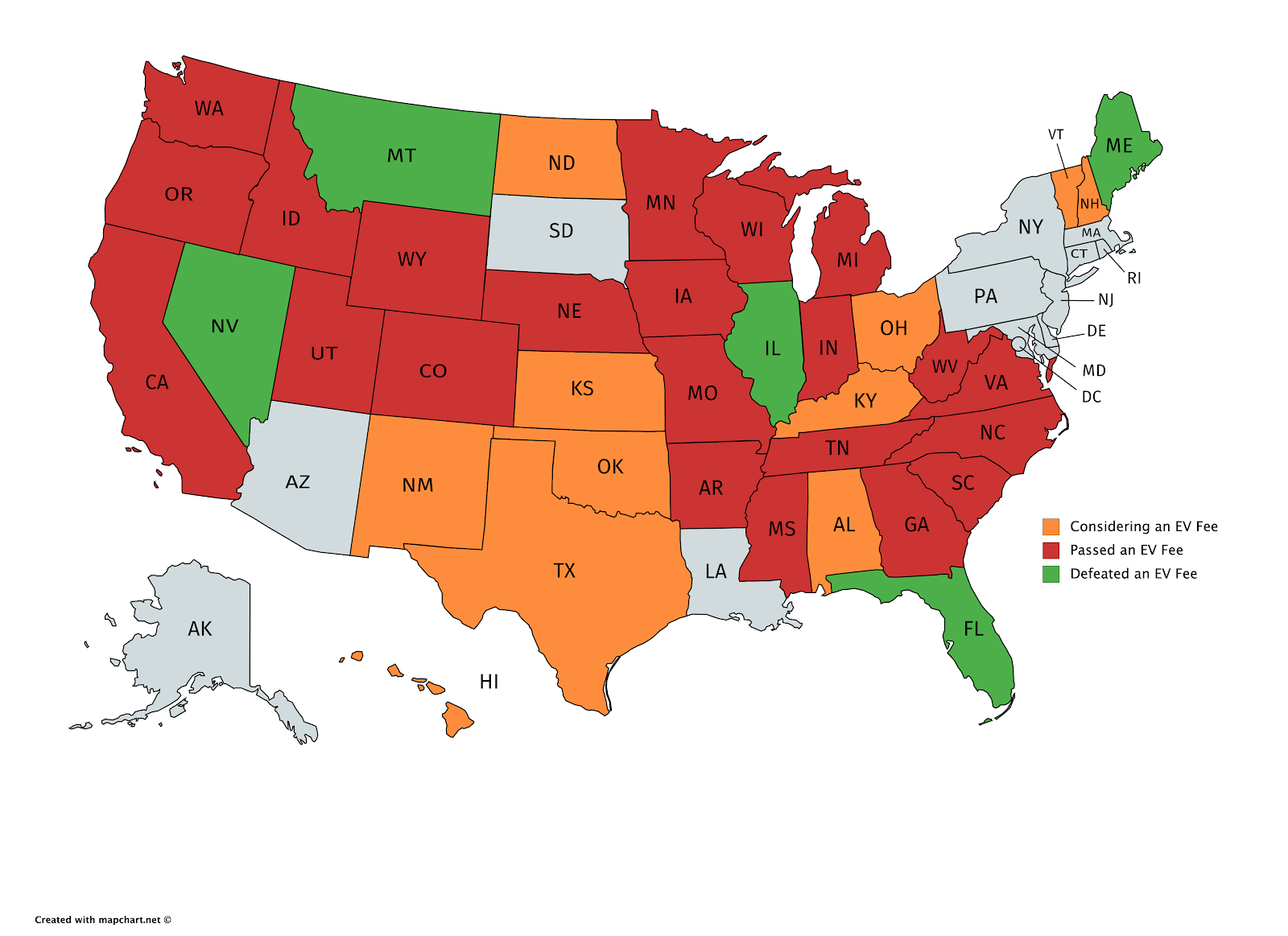

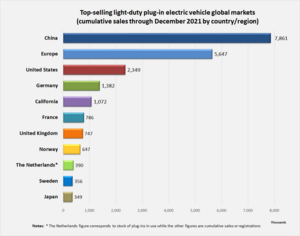

Alternative fuel vehicles and plug in hybrids washington state tax exemptions. The phase out of federal tax credits on the purchase of chevrolet plug in electric vehicles began when its gm parent hit its 200 000 unit cap at the end of 2018. The credit amount will vary based on the capacity of the battery used to power the vehicle. The exemption applies to dealer and private sales of new used and leased vehicles sold on or after august 1 2019.

In washington new vehicles are subjected to a sales tax of 6 8. Several states and local utilities offer additional electric vehicle and solar incentives for customers often taking the form of a rebate. On august 1 2019 the sales and use tax exemption was reinstated for the sales of. Federal and state electric car tax credits incentives rebates.

Its stepped phase out to 50 started on april 1 2019 and continued until sept. 1 2019 july 31 2021. With this tax credit customers could be getting a rebate on the sales tax they pay up to 2 500 on new electric vehicles that cost less than 45 000. They can receive a rebate of up to 1 600 on the purchase.

Washington entices locals to go green with numerous money saving green driver incentives these eco friendly perks include emissions test exemptions for electric vehicles hybrids and other fuel efficient vehicles state and federal tax incentives auto insurance discounts and more. Tax credits for heavy duty electric vehicles with 25 000 in credit available in 2017 20 000 in 2018 18 000 in 2019 and 15 000 in 2020. The federal government provides a substantial tax credit for new battery electric and plug in hybrid evs ranging from 2 500 7 500 depending on the capacity of the ev s battery. At least 50 of the qualified vehicle s miles must be driven in the state and the credit expires at the end of 2020.

All battery electric vehicles are eligible for the full 7 500 whereas some plug in hybrids with smaller batteries receive a reduced amount. Charging customers who purchase qualified residential charging equipment between january 1 2018 and december 31 2020 may receive a tax credit of up to 1 000.