Electric Car Tax Credit 2018 Irs

Was the quirky 2012 mitsubishi i miev it s long gone now leaving the 2020 mitsubishi outlander phev as the only plug in car in the company s lineup.

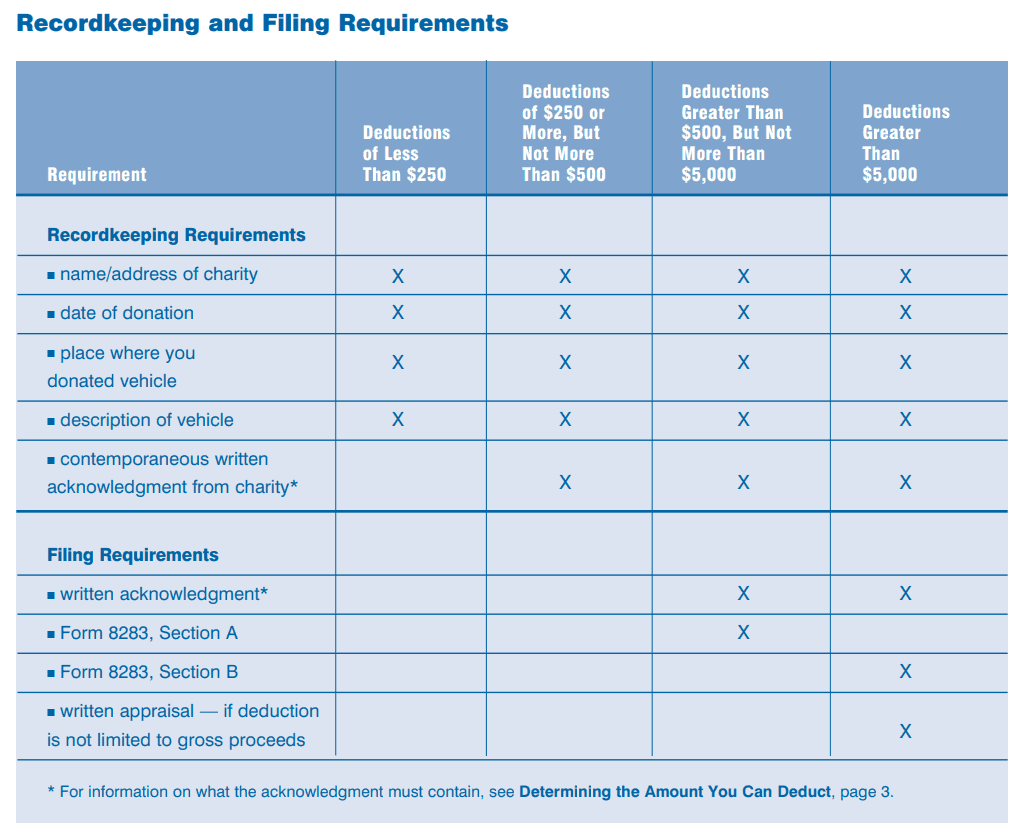

Electric car tax credit 2018 irs. Claiming the federal electric vehicle tax credit. Notice 2013 67 qualified 2 or 3 wheeled plug in electric vehicle credit under section 30d g. Notice 2009 89 new qualified plug in electric drive motor vehicle credit. After that part iii assuming the car was not a business investment you ll go through the process of subtracting the credit from your taxes owed on form 1040 line 47.

The irs gives detailed instructions for how to fill out these forms on their website but we ve broken down. The honda clarity fuel cell does not qualify for the rebate. About publication 463 travel entertainment gift and car expenses. With only one niche vehicle in a tiny model lineup it could be decades before mitsubishi approaches the.

Notice 2016 15 updating of address for qualified vehicle submissions. For vehicles acquired after 12 31 2009 the credit is equal to 2 500 plus for a vehicle which draws propulsion energy from a battery with at least 5 kilowatt hours of capacity 417. Washington the irs announced today that tesla inc. Size and battery capacity are the primary influencing factors.

One of the first electric vehicles sold in the u s. The credit amount will vary based on the capacity of the battery used to power the vehicle. In order to claim the federal electric vehicle tax credit once you buy an electric car you ll need to fill out irs form 8936 and report the proper credit from the form on form 1040 individual income tax return. With the vehicle identification number vin and certificate from the dealership the first part will be easy.

Ir 2018 252 december 14 2018. All form 8936 revisions. All electric and plug in hybrid cars purchased new in or after 2010 may be eligible for a federal income tax credit of up to 7 500. Federal tax credits for new all electric and plug in hybrid vehicles federal tax credit up to 7 500.

Qualified plug in electric drive motor vehicles irc 30d internal revenue code section 30d provides a credit for qualified plug in electric drive motor vehicles including passenger vehicles and light trucks. You must have purchased it in or after 2010 and begun driving it in the year in which you claim the credit. The value of the irs tax credit ranges from 2 500 to 7 500 depending on the electric vehicle in question. Hopefully that number exceeds 7 500 for the tax year.

You may be eligible for a credit under section 30d a if you purchased a car or truck with at least four wheels and a gross vehicle weight of less than 14 000 pounds that draws energy from a battery with at least 4 kilowatt hours and that may be recharged from an external source. Has sold more than 200 000 vehicles eligible for the plug in electric drive motor vehicle credit during the third quarter of 2018 this triggers a phase out of the tax credit available for purchasers of new tesla plug in electric vehicles beginning jan. Electric car tax credits are available if they qualify.

/irs-form-8962.resized-4c525af04e6347f296d912d00785f2f2.png)